Additional medicare tax calculator

Did you like the FICA tax calculator. Foreign Tax CreditThis is a non-refundable credit that reduces the double tax burden for taxpayers earning income outside the US.

How To Calculate Additional Medicare Tax Properly

Individuals making over 500000 are also subject to an additional 5 gradual adjustment tax on the excess income over 500000 up to certain limits.

. Employers and employees split that. For Social Security tax. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries.

Check if you are Non-Resident Alien. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. For Medicare tax Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income.

Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

State Income Tax Withheld. For more details about contributions to United States social security and medicare. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Starting in 2013 people with high salaries will pay a new additional Medicare tax of 09. This rate consists of the two parts mentioned above. Social Security is known for the cash benefits it provides to.

Tax Calculator Tax Brackets Capital Gains Social Security Tax Changes for 2013 - 2022. Exemption from Withholding. An additional Medicare tax of 09 may also be tacked on to your tax bill.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. You can claim a tax credit of up to 54 for the state unemployment tax you pay. Form 8959 Additional Medicare Tax.

In other words a self-employed person has to pay 124 for Social Security Tax and 29 for Medicare Tax. Additional NY Payroll Tax Resources. Calculate your total tax due using the MN tax calculator update to include the 202223 tax brackets.

This income tax calculator can help estimate your average income tax rate and your take home pay. The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Since 1966 the Medicare HI tax rate has risen though its still below the Social Security tax rate.

In Durham and Orange counties specifically there is an additional 05 tax which is used to fund the Research. 518 485-6654 Register for Withholding Taxes. Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple.

What are the limits on self-employment taxes. Choose Tax Year and State. Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund.

Unlike the rest of Medicare this new tax depends on your filing status. Medicare can actually be thought of as 2 separate taxes. Your household income location filing status and number of personal exemptions.

Employees paid their share when their employers deducted it from their paychecks. After-Tax Adjustments After-tax Adjustments Prior YTD CP. The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

The 29 tax we already discussed and an extra 09 tax on all income above a threshold. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Please note I said all income again because you have to include your W-2 job income.

Our calculator can help you do most of the heavy lifting but here are some additional resources and contact information you may need to start running payroll in New York. The child tax credit starts to phase out once the income reaches 200000 400000 for joint filers. Today the Medicare tax rate is 29.

And if youre a high wage earner youll still have to pay the 09 Additional Medicare Tax above your earnings threshold. Medicare taxes are 29 of earned income and Social Security taxes are 124 of earned income. Similar to the Medicare Tax this is a portion of your self-employed tax that supports another government program specifically the Social Security program.

Now for high income earners. Only you as the employer are responsible for. Deduct and match any FICA taxes to cover Medicare and Social Security taxes.

Please read more on a self-employment tax calculator with faqs. The self-employment tax rate is currently approximately 153. Which ranges from 2 to 225 in most counties.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Generally Medicare is available for people age 65 or older younger people with disabilities and people with End Stage Renal Disease. For a complete list of available plans please contact 1-800-MEDICARE TTY users should call 1-877-486-2048 24 hours a day7 days a week or consult wwwmedicaregov.

The Tax Calculator allows you to enter specific details including your filer status number of children different states your retirement funds any withholding so amounts FICA and other elements that support a more detailed tax. 202223 Minnesota State Tax Refund Calculator. Form 8960 Net Investment Income TaxIndividuals Estates and.

How to calculate Federal Tax based on your Annual Income. New York Department of Taxation Finance withholding assistance. Child Tax CreditIt is possible to claim up to 2000 per child 1400 of which is refundable.

The current Social Security tax is 124 with employees and employers each paying 62. This threshold is based on your filing status ie married single etc. May be assessed an additional Medicare tax equal to 09 of any income above the.

Self Employment Tax Calculator 2022.

How To Calculate The Net Investment Income Properly

H8i71hek1zf Lm

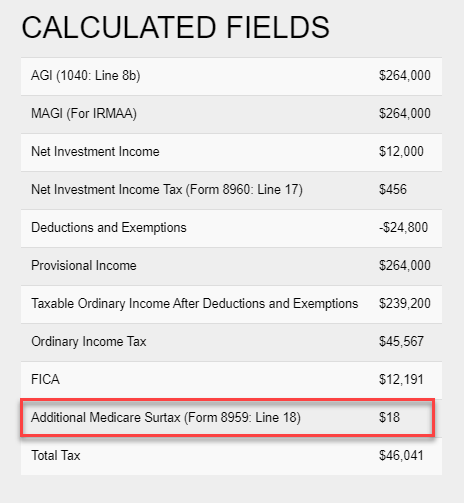

How To Calculate Additional Medicare Tax Properly

Easy Net Investment Income Tax Calculator

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Solved Payroll Items Ss Medicare Are Not Calculated Automatically

How To Calculate Additional Medicare Tax Properly

What Is Fica Tax Contribution Rates Examples

Additional Medicare Tax Calculator With How Why What Explanation Internal Revenue Code Simplified

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How Is The Medicare Surtax Calculated In Tax Clarity

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Personal Finance Iyi Nc Baamboozle

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Penalties For High Income Earners Financial Samurai

Additional Medicare Tax H R Block